Workers Exempt From All of the Flsa Requirements Include

Bemployees paid by the hour. Commonly known as the FLSA requires that most employees in the United States be paid at least the federal minimum wage for all hours worked and overtime pay at not less than time and one-half the regular rate of pay for all hours worked over 40 hours in a workweek.

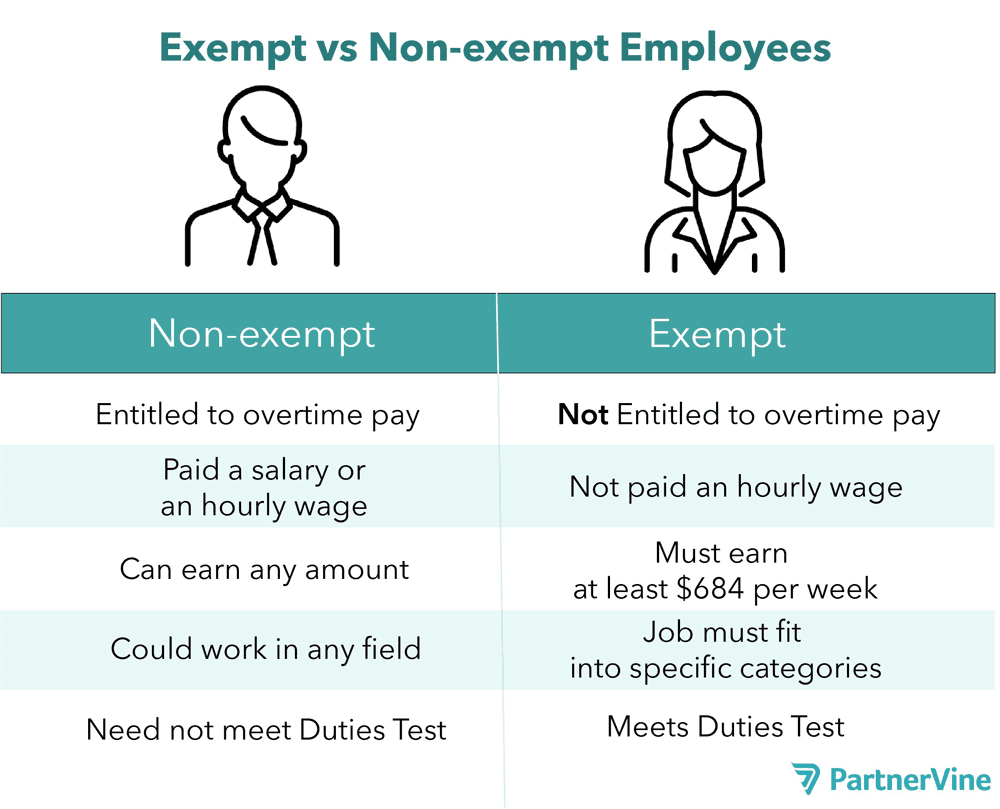

Overtime The Flsa And Exempt Vs Non Exempt Employees Partnervine

None of the above.

. As previously stated above when an employee is properly classified as exempt under the Fair Labor Standards Act FLSA he or she is exempt from the FLSAs minimum wage and overtime pay requirements. Generally if employees are paid on a salary basisthat is they have a guaranteed minimum amount of money they can count on receiving for any work week in which they perform any workthey are exempt. The details vary by state but if.

There are specific requirements for each exemption that must be met and you should be sure her duties and responsibilities fall within one of the exemptions. Employees paid by the hour C. Employees paid by the hour b.

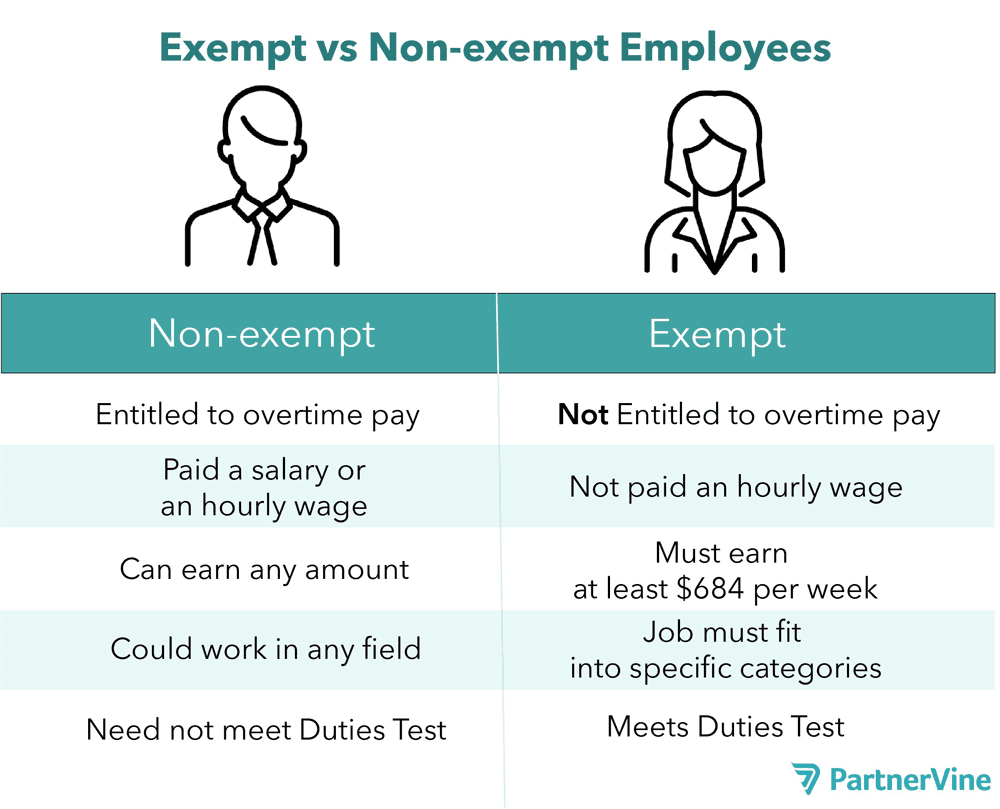

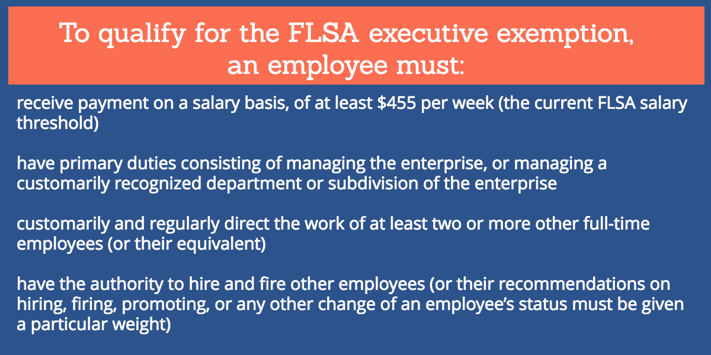

With few exceptions to be exempt an employee must a be paid at least 23600 per year 455 per week and b be paid on a salary basis and also c perform exempt job duties. The Fair Labor Standards Act FLSA mandates the federal minimum wage level and requirement to pay employees overtime for hours in excess of 40 per workweek. Professional administrative executive outside sales and computer-related.

Clerk-typists earning less than 200 a week. Dclerk-typists earning less than 200 a week. The FLSA requires that most employees in the United States be paid at least the federal minimum wage for all hours worked and overtime pay at not less than time and one-half the regular rate of pay for all hours worked over 40 hours in a workweek.

Employees who perform office or nonmanual work and are paid total annual compensation of 100000 or morewhich must include at least 684 per week paid on a salary or fee basisare exempt from the FLSA if they regularly perform at least one of the duties of an exempt executive administrative or professional employee as described earlier. Employees primarily performing work that is not subject to overtime provisions of the Fair Labor Standards Act. Employees paid by the hour.

Nothing in the FLSA prohibits an employer from requiring exempt employees to punch a clock or work a particular schedule or make up time lost due to absences. Motion picture theater employees e. The FLSA includes these job categories as exempt.

Exempt professional employees are exempt from all provisions of the FLSAminimum wages overtime pay and equal pay asked Aug 1 2017 in Business by Emir02 accounting-and-taxation. Highly compensated employees performing office or non-manual work and paid total annual compensation of 107432 previously 100000 or more which must include at least 684 per week as of 112020 previously 455 per week paid on a salary or fee basis are exempt from the FLSA if they customarily and regularly perform at least one of the duties of an exempt. Motion picture theater employees.

ENone of these choices are correct. Employees primarily performing work that is subject to the overtime provisions of the Fair. Clerk-typists earning less than a 200 a week.

View Feedback 2 2 poin If an employee works two jobs at two different wage rates for the same employer during the same pay week any overtime pay must be calculated by using an overtime hourly rat of. Amotion picture theater employees. Workers exempt from all of the FLSA requirements include.

Social workers who supervise two or more employees may fall. However Section 13 a 1 of the FLSA provides an exemption from both minimum wage and overtime pay for employees employed. 203 et seq.

These requirements are outlined in the FLSA Regulations promulgated by the US. Workers exempt from all of the FLSA requirements include a. Workers exempt from all of the FLSA requirements include.

When considering social workers there are three relevant exemptions - the so-called white-collar exemptions - executive administrative and professional. Motion picture theater employees. This preview shows page 1 - 3 out of 4 pages.

None of the above. The FLSA does not require that overtime be paid to nonexempt employees for hours worked in excess of eight-hours per day or on weekends or holidays. Clerk-typists earning less than 200 a week.

While there are many more components to the FLSA these are two that tend to get a lot of attention. Ratings 100 1 1 out of 1 people found this document helpful. The Fair Labor Standards Act FLSA establishes minimum wage overtime pay recordkeeping and youth employment standards affecting employees in the private sector and in Federal State and local governments.

The Fair Labor Standards Act of 1938 29 USC. Chamberlain Kaufman and Jones is a law firm with a nationwide reputation in helping employees receive the wages they are due for all hours worked specializing in overtime law specifically collection of unpaid overtime pay due under the Federal Fair Labor Standards Act FLSA. About all an exempt employee is entitled to under the FLSA is to receive the full amount of the base salary in any work period during which she performs any work less any permissible deductions.

In 1996 however Congress amended the FLSA to include a specific exemption at Section 13 a 17 for Computer Professionals. Position is exempt from the FLSA. Overtime pay is not required by FLSA for exempt employees.

Most employers are subject to the FLSA but there. Workers exempt from all of the FLSA requirements include. If employees are paid less than 23600 per year they are considered non-exempt.

The exemptions include the executive exemption the administrative exemption the professional exemption the outside sales exemption the creative professional exemption and the certain computer employees exemption. However the University chooses to pay overtime to exempt Non-V Class employees. The Fair Labor Standards Act is designed to insure that wage earners are compensated for.

Workers exempt from all of the FLSA requirements include. Previously computer professionals had been considered exempt under section 13 a 1 along with the exemption for executives administrators and professionals but under Section 13 a 17 a specific exemption was. Employees who earn at least 107432 a year may be classified as exempt if their primary duty includes performing office or non-manual work blue-collar workers cant qualify no matter how much.

Covered nonexempt workers are entitled to a minimum wage of not less than 725 per hour effective July 24 2009.

Flsa Executive Exemption How Do You Know Who Qualifies

What Is An Exempt Employee Requirements Qualifications And More

How Exempt Vs Non Exempt Classification Works Employers Resource

Comments

Post a Comment